The Science Behind Location in Commercial Real Estate: Maximizing Value Through Strategic Positioning

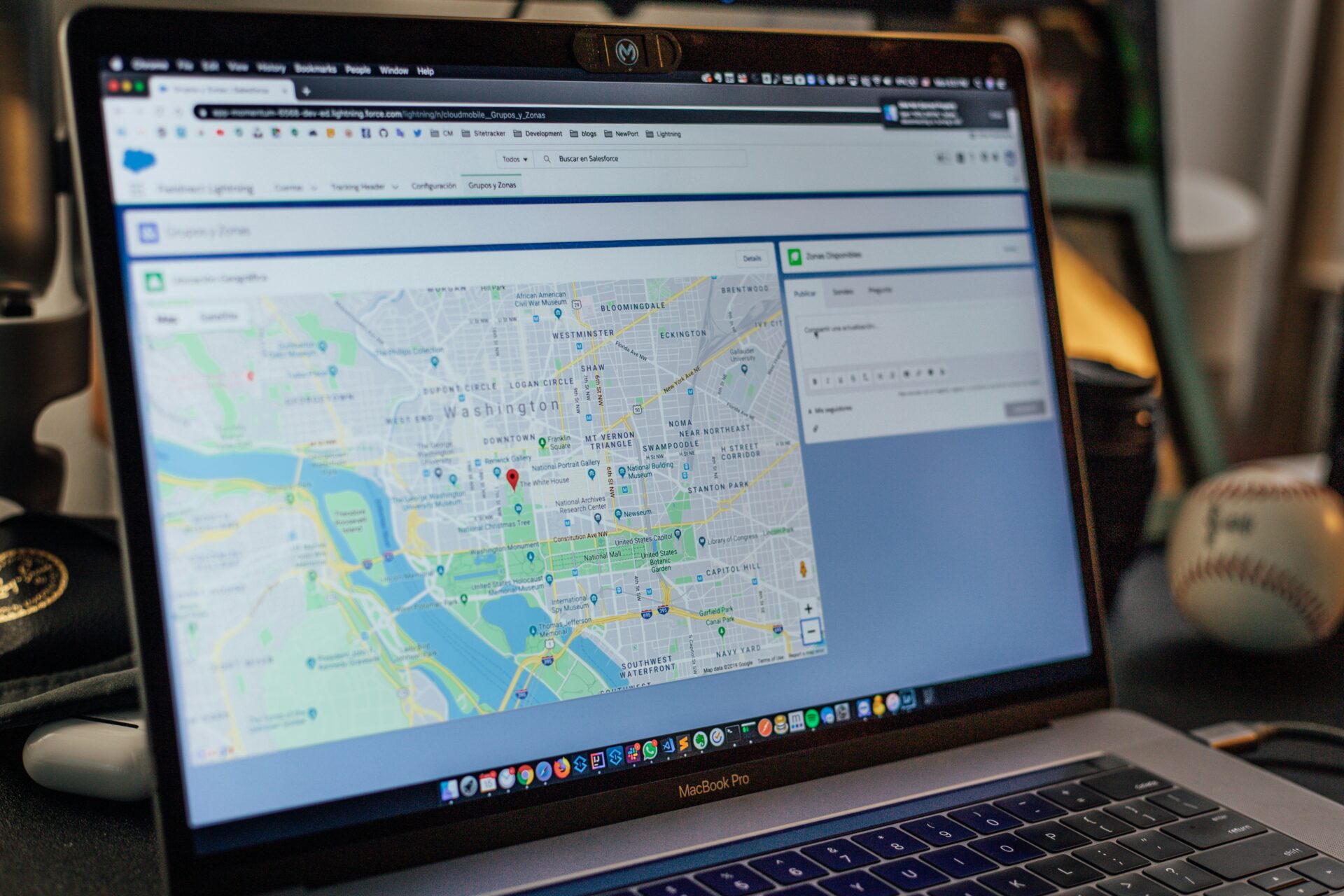

In the world of commercial real estate, one axiom reigns supreme: “Location, location, location.” While it may sound like a simple mantra, the science behind selecting the right location for commercial properties is multifaceted and deeply rooted in economic, demographic, and geographic principles. Understanding the intricacies of location selection is crucial for investors, developers, and tenants alike, as it can significantly impact property value, tenant demand, and overall investment success. Let’s delve into the science behind location in commercial real estate and explore why it matters.

1.) Economic Drivers: Economic factors play a pivotal role in determining the attractiveness of a location for commercial real estate investment. Cities and regions with strong economic fundamentals, such as robust job growth, high disposable incomes, and diverse industries, tend to attract businesses and drive demand for commercial properties. Investors often seek locations with favorable economic indicators to mitigate risk and capitalize on growth opportunities.

2.) Accessibility and Connectivity: Accessibility and connectivity are key considerations in location selection, especially for retail and office properties. Proximity to major transportation arteries, such as highways, airports, and public transit hubs, enhances accessibility and facilitates customer and employee mobility. Properties situated in well-connected locations benefit from higher visibility, increased foot traffic, and easier commute access, making them more desirable to tenants and customers alike.

3.) Demographic Dynamics: Demographic factors, including population density, age distribution, income levels, and household composition, shape the demand for commercial real estate in a given location. Retailers, for example, target areas with dense populations and high disposable incomes to capture consumer spending. Similarly, office tenants may seek locations with a skilled labor pool and a favorable demographic profile to attract and retain talent. Understanding local demographic trends allows investors to align property offerings with market demand effectively.

4.) Zoning and Land Use Regulations: Zoning laws and land use regulations exert a significant influence on commercial real estate development and investment decisions. Municipalities enact zoning ordinances to regulate the use of land and control urban development, dictating permissible land uses, building heights, setbacks, and parking requirements. Investors must navigate zoning regulations to identify suitable locations for their desired property type and ensure compliance with local planning regulations.

5.) Market Dynamics and Competition: Analyzing market dynamics and competitive forces is essential for assessing the viability of a location for commercial real estate investment. Investors evaluate supply and demand dynamics, vacancy rates, rental trends, and competitive property offerings within a given market to gauge investment potential. Identifying underserved markets or submarkets with strong demand fundamentals can present lucrative investment opportunities and competitive advantages.

6.) Environmental Considerations: Environmental factors, such as topography, climate, natural hazards, and environmental quality, can influence the suitability of a location for commercial real estate development. Properties located in environmentally sensitive areas or prone to natural disasters may carry higher risks and require additional due diligence. Conversely, environmentally sustainable practices, such as green building certifications and energy-efficient design, can enhance property value and appeal to environmentally-conscious tenants.

7.) Urbanization and Urban Revitalization: The global trend towards urbanization and urban revitalization is reshaping the commercial real estate landscape, with increasing emphasis on mixed-use developments, transit-oriented projects, and urban infill opportunities. Investors are drawn to vibrant urban cores and revitalized neighborhoods offering a mix of residential, commercial, and cultural amenities. Urban locations benefit from density, walkability, and a sense of place, driving demand for commercial properties in dynamic urban environments.

The science behind location in commercial real estate encompasses a myriad of economic, demographic, regulatory, and environmental factors that influence investment decisions and property performance. By leveraging data-driven analysis, market insights, and strategic foresight, investors and developers can identify prime locations, mitigate risks, and maximize value creation in the dynamic and competitive commercial real estate market.

Disclaimer: The information provided in this article is for educational and informational purposes only. It is not intended to be, nor should it be construed as, financial, legal, or investment advice. Readers are advised to consult with qualified professionals, such as financial advisors, attorneys, and/or real estate experts, before making any financial decisions or entering into any commercial real estate transactions. The author and publisher of this post make no representations or warranties regarding the accuracy, completeness, or suitability of the information provided herein. The use of this information is at the reader’s own risk.

Share This Article: